Review by Liv & Luv Blog

3 February 2015

Those who lived through the Japanese Occupation of our country know what it’s like to live frugally. I remember my grandmother (whom we fondly called Opah) telling us that she ensured her children would never go hungry by living well within her means.

Although my grandmother has passed on since, her words of wisdom stayed with me. So imagine my delight when I came across some of Opah’s tried-and-tested money-saving tips when I was reading this book.

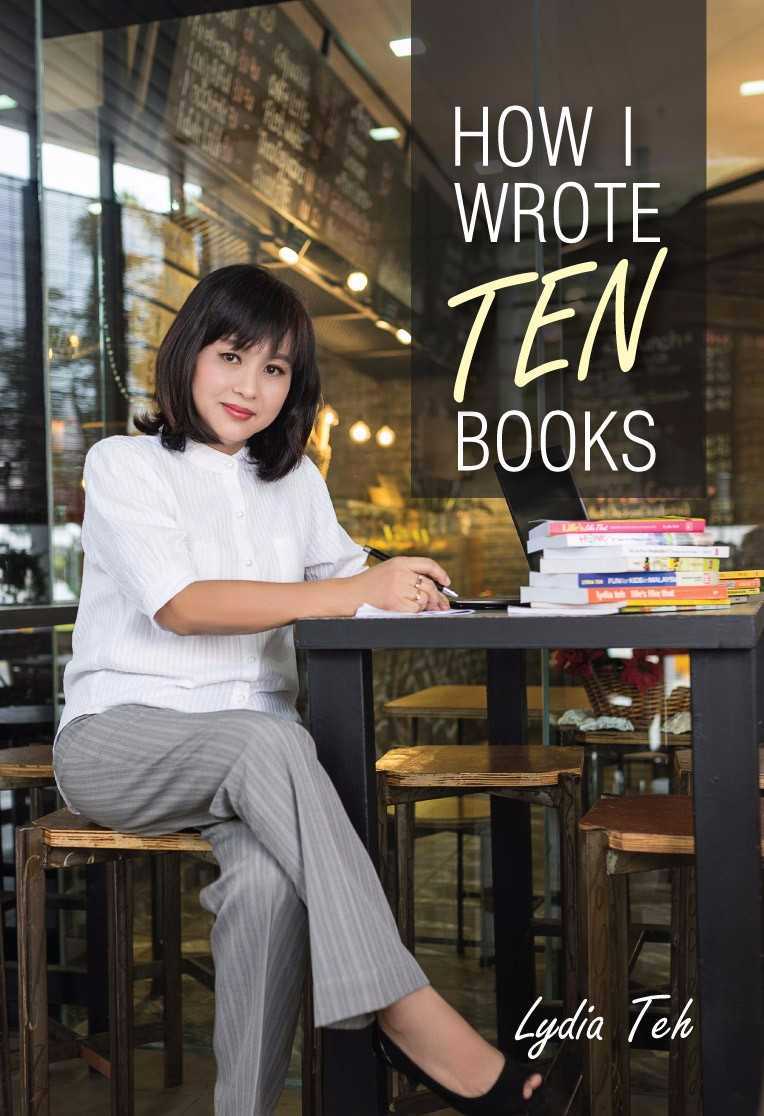

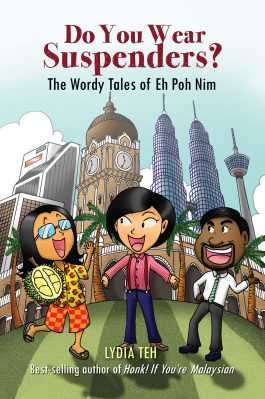

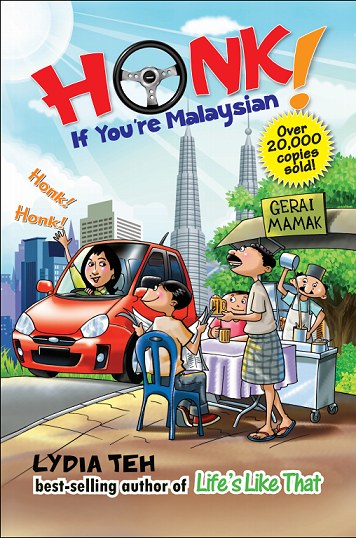

Lydia Teh is a renowned Malaysian author and newspaper columnist who has seven other books to her name including the best-selling Honk! If You’re Malaysian. She is also a mother of four children.

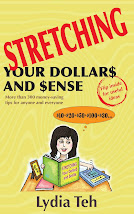

As stated on its cover, the book contains more than 300 money-saving tips for anyone and everyone. In today’s tough economic climate, it pays to be prudent and there is no better way than to trim down your expenses. This book will help you do just that. It is chock-full of sensible money-saving suggestions that you can immediately apply in many areas of your life.

The tips are compiled into 11 Chapters entitled: Tightening the Belt, Super Shopper Savers, Prudent Household Tips, Utility Savings, Grooming for Less, Money Matters Most, Paying Less Tax is a Relief, Thrifty Transport Tips, Savings on Special Occasions, Leisure on a Budget and Miscellaneous and More Savings.

Every chapter consists of more than 10 tips and each tip is explained adequately. Whether you are a home-maker, a student, a salary earner or a business owner, the book covers a wide range of money-saving ideas which can easily be put into practice. The book ends with a few pages of lovely Quotations on Frugality and Simple Living and there is also a Glossary of words which is helpful to a non-Malaysian reader.

Let me assure you that this book is not telling you to stop spending completely. The writer emphasizes this in her introduction and recommends that what we should do instead is to make smarter choices and manage our finances better. I could not agree more.

Something that lends a very special touch to this book is how the writer has shared her experiences in using the tips herself. She is neither shy nor afraid of giving readers a glimpse into her personality. Some examples include the time she bought a denim jacket with two missing buttons because it was on discount and how she is known as the ‘leftover’ queen in her family.

It is also important to be aware that not every tip in this book is acceptable to everyone but those are few and far between. For instance, some readers may disagree with the writer on the tip about movie squatters. Instead of buying a ticket, you get your young child to share your seat with you or let the child sit on the stairs if you have an aisle seat. The downside to this is that the child may throw a tantrum when he or she becomes uncomfortable and this will consequently reduce the movie-watching experience for yourself and other paying patrons.

The writer acknowledges that she does not expect all the tips in this book to be used. However, given that there are more than 300 tips available, there is a wide variety for you to choose from.

I would recommend this book to anyone who is looking for various ways to save money in his or her daily life. It can also be a nice gift for a friend or relative whom you think may appreciate some help in getting their expenses under control.

Wednesday, February 04, 2015

Subscribe to:

Posts (Atom)